💡 DIY Computer Fixes?

Grab my easy step-by-step guide and keep your computer running like new.

- Apple Pay Later: Buy Now, Pay Later with Guardrails

- Apple is launching a buy-now-pay-later service, Apple Pay Later, that will allow users to split their purchases into four equal payments over six weeks.

- The popularity of buy now pay later has skyrocketed since the pandemic began, particularly among younger and low-income consumers.

- Apple Pay Later, the new buy-now-pay-later service from Apple, will require users to connect a debit card and a bank account to make payments.

- Apple’s buy now, pay later product will also offer fraud and consumer protections through MasterCard’s existing pay-by-installment model.

- If you fail to make your payments on time, you may be subject to a fee, which may either be a flat rate or a percentage of the total you owe.

Apple Pay Later: Buy Now, Pay Later with Guardrails

Apple is launching a buy-now-pay-later service, Apple Pay Later, that will allow users to split their purchases into four equal payments over six weeks.

The service will be available to Apple Pay users in the United States and will not require a credit check. Apple Pay Later will report loans to credit bureaus, which could help users build their credit scores.

Apple Pay Later is expected to be available to a limited number of users in the spring of 2023 and will be rolled out more broadly in the fall.

The popularity of buy now pay later has skyrocketed since the pandemic began, particularly among younger and low-income consumers.

This type of financing allows shoppers to pay for purchases in installments, without having to use a credit card. Some popular buy now pay later services include Afterpay, Affirm, Klarna, and PayPal.

While buy now pay later can be a convenient way to finance purchases, it’s important to understand the terms and conditions of each service before you use it. Some services charge late fees if you miss a payment, and some may also report late payments to credit bureaus. It’s also important to make sure you can afford to make all the payments on time, as missing a payment could damage your credit score.

If you’re considering using buy now pay later, be sure to compare different services and read the fine print before you sign up.

Apple Pay Later, the new buy-now-pay-later service from Apple, will require users to connect a debit card and a bank account to make payments.

The company said that it will not charge flat or percentage late fees, but missed payments will eventually result in users losing access to the service.

This is in contrast to some other buy-now-pay-later services, which often charge late fees or interest on missed payments. Apple Pay Later also does not require a credit check, which could make it a more accessible option for some consumers.

It remains to be seen how popular Apple Pay Later will be, but it has the potential to be a convenient way for consumers to finance purchases without having to use a credit card.

Apple’s buy now, pay later product will also offer fraud and consumer protections through MasterCard’s existing pay-by-installment model.

In addition, Apple will charge merchants fees that are competitive to other installment products in the market.

Buy now, pay later services allow you to split your payments into equal parts, usually over four to six weeks. You can use a credit card or debit card to make the initial purchase, and then pay the rest of the balance in installments.

There are no interest charges if you pay on time, but late fees can apply. Some services will also report your payments to credit bureaus, which could help you build your credit score.

To use a buy now, pay later service, you’ll need to create an account and link a payment method. Once you’re approved, you can start using the service to make purchases.

Here are the steps on how to use a buy now, pay later service:

- Create an account with the buy now, pay later service.

- Link a payment method, such as a credit card or debit card.

- Choose the items you want to buy and add them to your cart.

- Select the buy now, pay later option at checkout.

- Enter the amount you want to pay upfront and the rest of the balance will be due in installments.

- Make your installment payments on time to avoid late fees.

Buy now, pay later services can be a convenient way to finance purchases, but it’s important to understand the terms and conditions before you use them.

If you fail to make your payments on time, you may be subject to a fee, which may either be a flat rate or a percentage of the total you owe.

These fees may reach up to $34 plus interest. If you miss multiple payments, you may be shut out from using the service in the future and your delinquency may hurt your credit score.

It is important to note that even though there are no interest charges for buy now, pay later services, late fees can still add up.

It is important to understand the terms and conditions of the buy now, pay later service before you use it.

Apple Pay Later will not charge late fees. However, if a user misses a payment, it will be reported to credit bureaus. The user will also lose access to Apple Pay Later.

If a user wants to defer a payment or set up a different payment plan, they can contact Apple support.

Apple Pay Later is a new product, so it is still too early to say how popular it will be. However, it has the potential to be a convenient way for consumers to finance purchases without having to use a credit card.

As of the moment, buy now, pay later services are not subject to the Truth in Lending Act, which regulates credit cards and other forms of loans. This means that there are no laws in place that specifically protect your purchases when you use a buy now, pay later service. However, there are some protections that you may still be entitled to, depending on the specific service you use. For example, some services may offer fraud protection or dispute resolution services. It is important to read the terms and conditions of any buy now, pay later service before you use it to understand what protections you are entitled to.

Without purchase protection, you may find it more difficult to resolve disputes with merchants, return items, or recover funds in cases of fraud. Companies are not required to provide these protections, but Apple does through Mastercard.

This version is more concise and easy to understand. It also includes the name of the company that provides the protections, which is Mastercard.

Apple’s decision not to allow consumers to link a credit card to its buy now, pay later product means that consumers avoid stacking debt in this way. However, because there is no centralized reporting of buy now, pay later purchases, those debts won’t necessarily appear on your credit profile with major credit rating agencies.

This version is more concise and easier to understand. It also includes the name of the company that provides the product, which is Apple.

Here are the other risks of buy now, pay later products:

- Overspending: Buy now, pay later products can make it easy to overspend, especially if you’re not careful to track your spending.

- Late fees: If you miss a payment, you may be charged late fees, which can add up quickly.

- Interest: Some buy now, pay later products charge interest, which can make your debt more expensive.

- Collection agencies: If you default on your buy now, pay later debt, it may be turned over to a collection agency, which can damage your credit score.

- Fraud: Buy now, pay later products are a popular target for fraudsters, so it’s important to be careful when using them.

It is important to read the terms and conditions of any buy now, pay later product before you use it.

More companies may let you buy more items, even if you can’t afford them, because lenders don’t know how many loans you have set up with other companies. Missed payments are reported to credit rating agencies, but on-time payments are not.

This version is more concise and easy to understand. It also includes the name of the companies that report missed payments, which are credit rating agencies.

Here is an additional information about the risks of buy now, pay later products:

- Debt trap: Buy now, pay later products can be a debt trap if you’re not careful. If you take out multiple loans, you could end up owing more money than you can afford to repay.

- Credit score impact: Buy now, pay later products can impact your credit score if you miss payments. Missed payments are reported to credit bureaus, which can lower your credit score.

- Legal issues: Buy now, pay later products are not regulated by the same laws as credit cards. This means that you may not have the same protections if you have a problem with a buy now, pay later product.

It is important to be aware of the risks of buy now, pay later products before you use them. If you are considering using a buy now, pay later product, it is important to read the terms and conditions carefully and to understand the risks involved.

Retailers offer buy now, pay later services because they increase cart sizes. Customers are more likely to add more items to their cart when they can pay for them in installments. This helps retailers to increase their sales and profits.

The following are the benefits of buy now, pay later for retailers:

- Increased sales: Buy now, pay later products can help retailers to increase their sales by making it easier for customers to buy the items they want.

- Higher average order value: Buy now, pay later products can also help retailers to increase their average order value by encouraging customers to add more items to their cart.

- Improved customer experience: Buy now, pay later products can provide a better customer experience by making it easier for customers to get the items they want without having to worry about how they will pay for them.

However, there are also some risks associated with buy now, pay later for retailers:

- Fraud: Buy now, pay later products can be a target for fraud, so retailers need to be careful about who they partner with.

- Bad debt: Buy now, pay later products can also lead to bad debt, which can be a problem for retailers.

- Customer dissatisfaction: If customers are not happy with their buy now, pay later experience, they may be less likely to shop with the retailer again.

Buy now, pay later loans are a good option for people who are able to make all payments on time. They can also help you build your credit score if you make all payments on time and avoid late fees. However, if you are not sure if you will be able to make all payments on time, a credit card may be a better option. Credit cards offer stronger legal protections and centralized reporting of loans.

Here are some tips for using buy now, pay later products responsibly:

- Make sure you can afford the monthly payments. Buy now, pay later products can be a good way to finance a purchase, but only if you can afford the monthly payments.

- Read the terms and conditions carefully. Before you use a buy now, pay later product, make sure you read the terms and conditions carefully. This will help you understand the fees and interest that you may be charged.

- Track your spending. It is important to track your spending when you use a buy now, pay later product. This will help you make sure that you are not overspending.

- Make all payments on time. Making all payments on time is important to avoid late fees and build your credit score.

By following these tips, you can use buy now, pay later products responsibly and avoid any problems.

As the cost of living increases, more people are using buy now, pay later products to make ends meet. This is leading to an increase in delinquencies, which could have a negative impact on the buy now, pay later industry.

Here are some of the ways that economic instability could affect buy now, pay later:

- Increased delinquencies: As the cost of living increases, more people may struggle to make their payments on time. This could lead to an increase in delinquencies, which could damage the reputation of the buy now, pay later industry.

- Reduced lending: If lenders become more cautious about lending to consumers, they may reduce the amount of money they lend to buy now, pay later companies. This could make it more difficult for consumers to get approved for buy now, pay later loans.

- Increased regulation: If the government becomes concerned about the risks of buy now, pay later, they may impose stricter regulations on the industry. This could make it more difficult for buy now, pay later companies to operate and could lead to higher prices for consumers.

Overall, economic instability could have a negative impact on the buy now, pay later industry. If you are considering using buy now, pay later, it is important to be aware of the risks involved.

That Tech Jeff can help you with your computer no matter where you live! Get online computer help or computer tutoring no matter where you live. Just read the more than 900 five-star reviews. (thumbtack and google combined)

That Tech Jeff has 26 years experience and has offered computer help online since 2007. Before you head to Geek Squad get That Tech Jeff’s advice. Its free.

Affordable and honest FLAT RATE online help – no hourly charge.

You pay just one price if your problems are fixed and nothing if not.

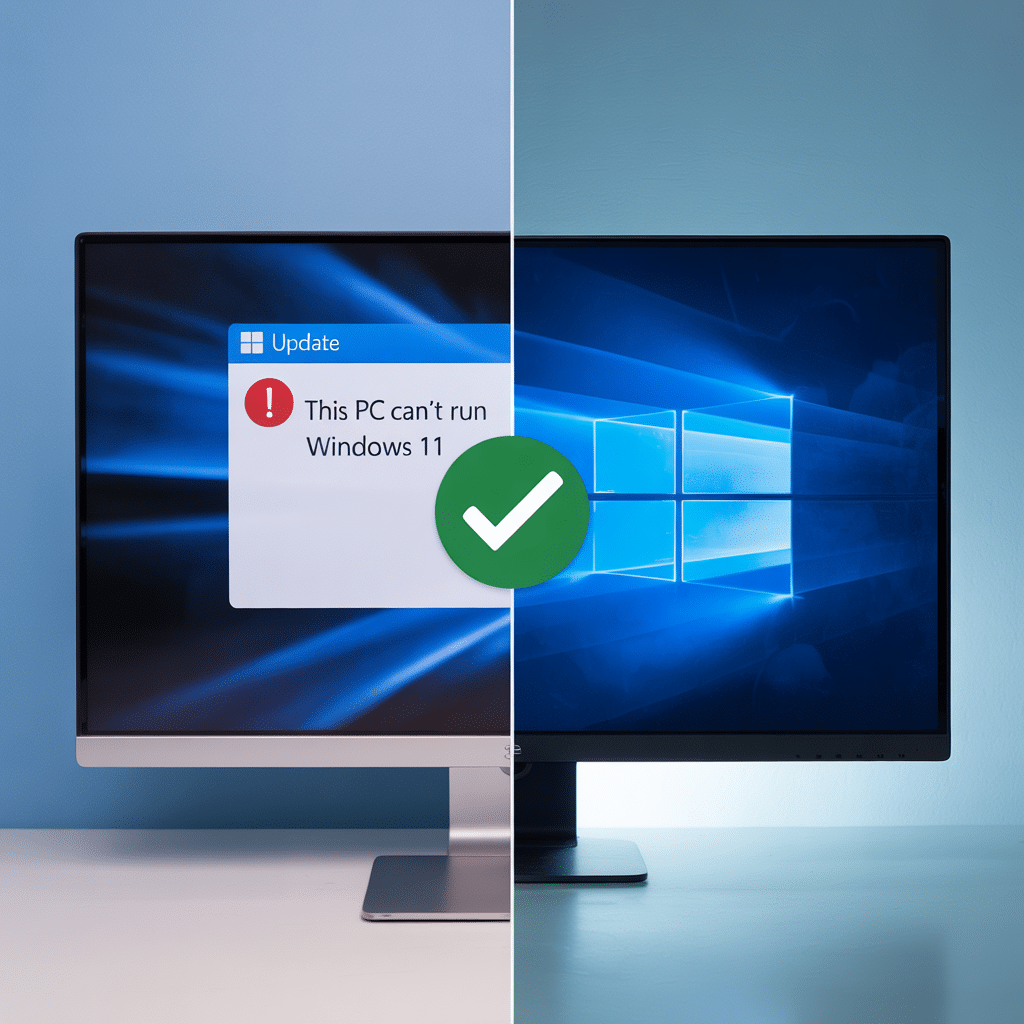

Windows Update Says Can’t Run Windows 11? Massive Mistake

If Windows Update says can’t run Windows 11 on [...]

How to Safely Shop Online (A Senior’s Guide)

Safely shop online for seniors with these 10 simple, [...]

Email Not Sending or Receiving? Here’s What to Do and How to Fix It

Email Not Sending or Receiving? Here’s What to Do [...]

Is Online Computer Help Really Safe in 2026? What Most People Worry About — and What Actually Matters

If the idea of letting someone access your [...]

Is Remote Computer Help Safe in 2026? The Honest Answer

Is Remote Computer Help Safe in 2026? If you’ve [...]

Still Using Windows 10 in 2026? Here’s What You Actually Need to Know

Still Using Windows 10 in 2026? Here’s What You [...]